More than half of U.S. households invest money in the stock market, typically as a way of saving for retirement. Investing is not usually viewed as gambling; however, whether it be a slot machine or a stock investment, both activities provide some level of risk and a chance of financial reward. Previous research has linked day trading, online stock trading, and high-risk stock investing to gambling-related problems or behaviors in different ways. This week, the WAGER reviews a study by Moritz Mosenhauer and colleagues that examined whether frequent stock market trades are indicative of problem gambling behavior.

What were the research questions?

(1) Is there an association between frequent stock trading and problem gambling? (2) Does this association persist after controlling for traders’ overconfidence, demographic characteristics, financial literacy, and overall investment portfolio size?

What did the researchers do?

The researchers conducted a cross-sectional study by recruiting 795 U.S. residents with investment portfolios and a prior history of gambling to complete a four-part survey including the Problem Gambling Severity Index, financial literacy scale, overconfidence questionnaire, and a self-reported synopsis of their past 12-month investing activity. They used an Ordinary Least Squares regression, and their key dependent variable was relative turnover1 (i.e., the volume of trades relative to the size of the portfolio). The study was pre-registered on the Open Science Framework. Using a hierarchical regression approach, the authors controlled for financial literacy, overconfidence, age, gender, and portfolio values.

What did they find?

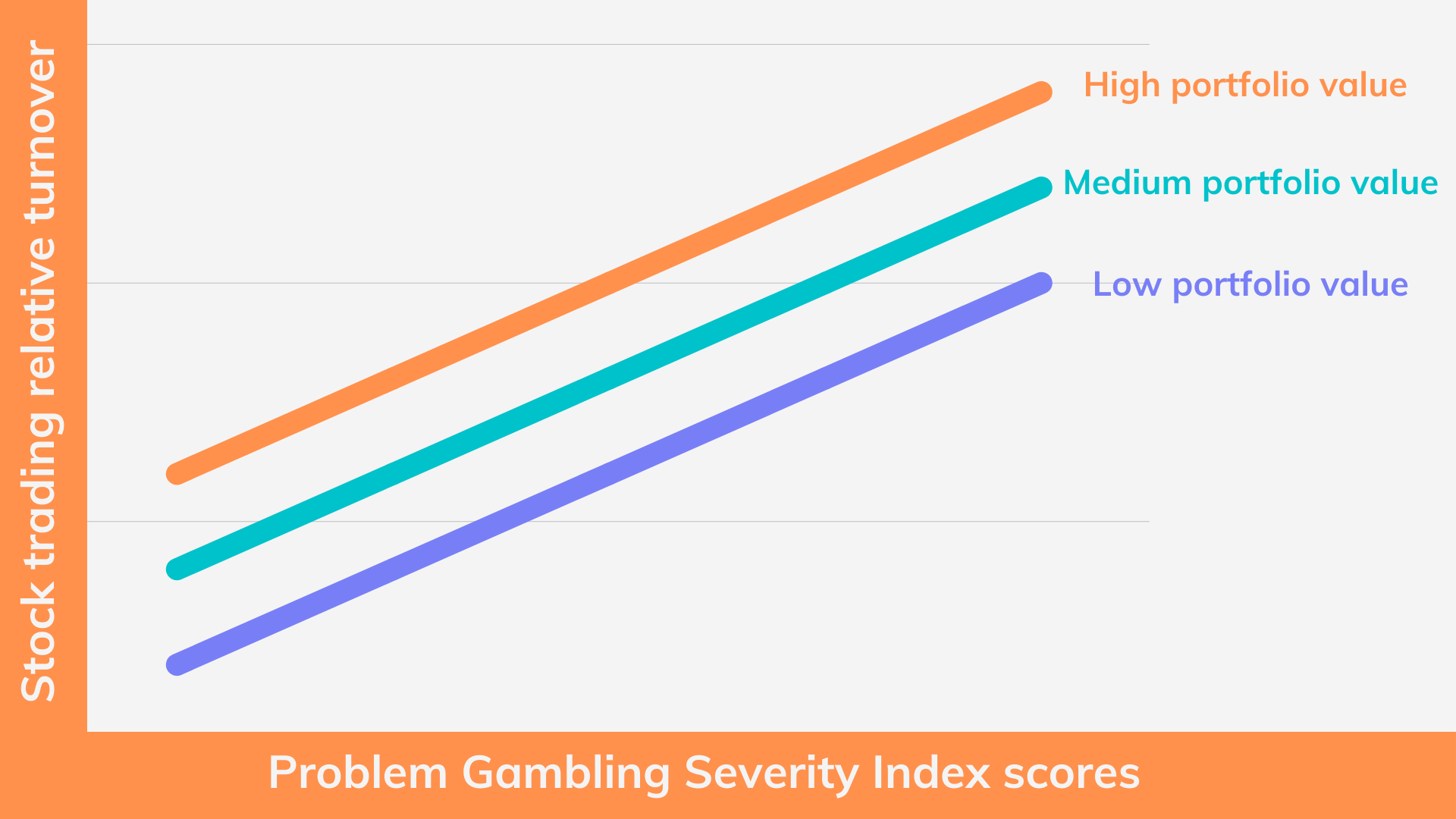

Higher relative turnover was associated with higher PGSI scores, even after controlling for financial literacy, overconfidence, age, and gender, which were all potentially confounding variables. Portfolio value was not related to relative turnover, nor was it associated with PGSI scores, indicating the monetary value of an individual’s portfolio did not have an effect on the relationship between PGSI scores and relative turnover (see Figure).

Figure. This graph uses hypothetical data to depict the finding that portfolio value did not impact the relationship between PGSI scores and stock trading relative turnover. Click image to enlarge.

Why do these findings matter?

This study found an association between potentially risky investment behavior, operationalized as frequent stock trading, and problem gambling, regardless of potentially confounding variables. Frequent stock trading might share similar underlying characteristics with problem gambling, such as impulsivity and risk seeking traits, despite typically not being considered as an important risk factor for gambling-related harm. Including questions about investment activity on problem gambling prevalence surveys could further explore this association. Financial literacy could be used as a way to combat some risky investment decisions; however, investors need to be mindful not to overestimate their own financial knowledge, similar to how gamblers can exaggerate their ability to predict game outcomes.

Every study has limitations. What are the limitations in this study?

The participants were a part of a convenience sample, which might not accurately portray U.S. investment activity or be representative of all U.S. adults. Participants were also asked to self-report their portfolio values which could result in over- or underestimation of actual values. Risk taking and impulsivity were not included as potential confounders.

For more information:

The Massachusetts Problem Gambling Helpline provides resources and treatment options for individuals experiencing problem gambling behavior, and The National Financial Educators Council has created an evidence-based free online course to educate individuals about financial literacy. The Massachusetts Technical Assistance Center for Problem Gambling Treatment (M-TAC) also provides educational resources and training programs for providers who want to learn how to best support their clients who are experiencing gambling-related problems. For additional addiction resources, please visit our Addiction Resources page.

— Nakita Sconsoni, MSW

What do you think? Please use the comment link below to provide feedback on this article.

________________

[1] The researchers calculated relative turnover by “adding the total value of purchases of securities to the total value of sales of securities to determine a measure of absolute turnover. This number was then divided by the average portfolio size, yielding the measure of relative turnover“ (p. 685).

Ken C Winters May 18, 2022

Nakita, great summary!