Cigarette taxes are effective in reducing smoking (Chaloupka, Yurekli, & Fong, 2012; Wilson & Thomson, 2005). Other smoking reduction policies, such as smoking bans, are associated with reductions in alcohol consumption(Kasza, McKee, Rivard et al., 2012), perhaps because smoking and drinking often go hand-in-hand. This week, in this second installment of our Special Series on Alcohol Awareness Month, ASHES reviews a longitudinal study that examines whether higher cigarette taxes are associated with reduced drinking behavior (Young-Wolff, Kasza, Hyland et al., 2014).

Methods

- Researchers used data from Waves I and II of the National Epidemiologic Survey on Alcohol and Related Conditions (NESARC), a US-representative general household survey (Grant, Moore, & Kaplan, 2003).

- Participants were limited to those who reported any past-year alcohol use in the Wave I survey.

- Participants were 10,936 people from states that increased their cigarette taxes between Waves I and II of the study and 10,537 people from states that did not change in cigarette taxes during that time.

- The researchers assessed drinking frequency, amount of alcohol consumed, binge drinking, and past-year smoking at each wave.

- State taxation policy was determined from The Tax Burden on Tobacco(Orzechowski and, 2009).

- The authors conducted a series of gender and smoking status linear regression analysis to determine the relation between cigarette taxes and drinking outcomes.

Results

- Overall, people tended to drink less at Wave II than at Wave 1.

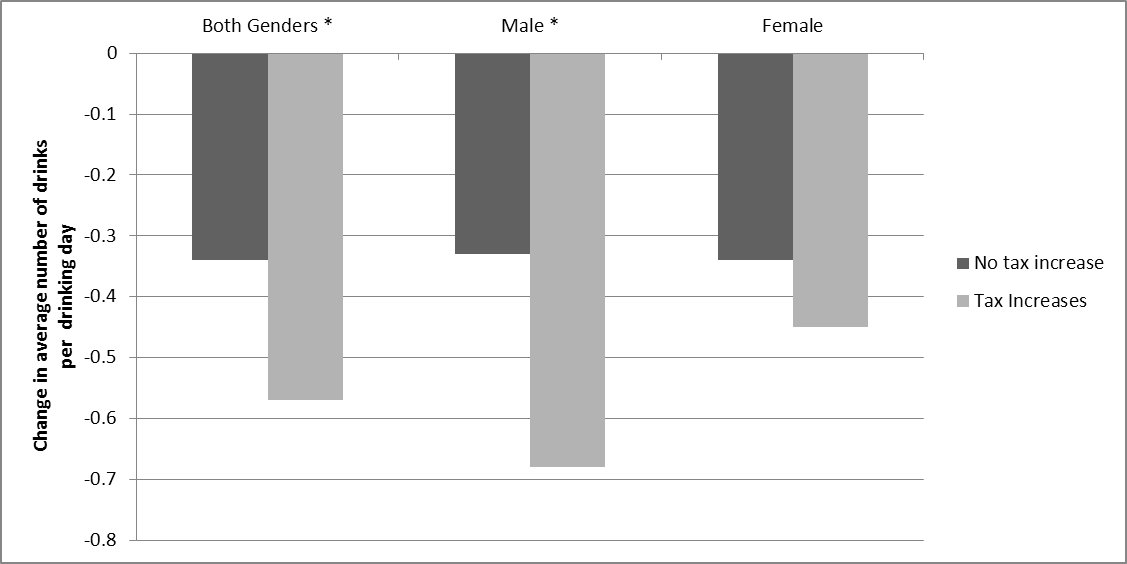

- However, as Figure 1 illustrates, smokers in states with an increase in cigarette tax showed a larger decrease in amount of alcohol consumed per day and frequency of binge drinking than did smokers in states with no cigarette tax increase.

- This effect was larger for males than females for number of drinks per drinking day. Overall, nonsmokers generally showed a decrease in drinking behaviors. There was no difference in terms of states with and without increased cigarette taxes.

Figure. Change in average number of drinks in per drinking day. *p < 0.05 (adapted from Young-Wolff et al.). Click image to enlarge.

Figure. Change in average number of drinks in per drinking day. *p < 0.05 (adapted from Young-Wolff et al.). Click image to enlarge.

Limitations

- The authors did not measure or control for change in alcohol tax. It might be that changes in alcohol tax accompanied changes in cigarette tax and were responsible for changes in drinking behavior.

- Self-report data may be inaccurate.

- States raised their taxes at different points in time and by differing amounts and the model does not account for this.

Conclusion

Smokers in states that increased their cigarette tax showed steeper declines in alcohol consumption and binge drinking. One possible explanation is that the increased cost of smoking reduces the disposable income that could be used for alcohol purchases. Cigarette taxes have less of a direct influence on non-smokers, so it is not surprising that higher cigarette taxes were unrelated to drops in drinking. Although causal relationships cannot be determined without additional studies, these results suggest that policies targeting alcohol or smoking might result a cross-over effect.

— Jed Jeng

References

Chaloupka, F. J., Yurekli, A., & Fong, G. T. (2012). Tobacco taxes as a tobacco control strategy. Tobacco Control, 21(2), 172-180.

Grant, B. F., Moore, T. C., & Kaplan, K. (2003). Source and accuracy statement: wave 1 national epidemiologic survey on alcohol and related conditions (NESARC). Bethesda, MD: National Institute on Alcohol Abuse and Alcoholism, 52.

Kasza, K. A., McKee, S. A., Rivard, C., & Hyland, A. J. (2012). Smoke-free bar policies and smokers’ alcohol consumption: Findings from the International Tobacco Control Four Country Survey. Drug and Alcohol Dependence, 126(1), 240-245.

Orzechowski and, W. (2009). The Tax Burden on Tobacco: Historical Compilation: Orzechowski and Walker Arlington, VA.

Wilson, N., & Thomson, G. (2005). Tobacco tax as a health protecting policy: a brief review of the New Zealand evidence. New Zealand Medical Journal, 118(1213).

Young-Wolff, K. C., Kasza, K. A., Hyland, A. J., & McKee, S. A. (2014). Increased Cigarette Tax is Associated with Reductions in Alcohol Consumption in a Longitudinal US Sample. Alcoholism: Clinical and Experimental Research, 38(1), 241-248.

What do you think? Please use the comment link below to provide feedback on this article.