More than two-thirds of people seeking treatment for Substance Use Disorders (SUD) smoke cigarettes. Incorporating smoking cessation as part of SUD treatment has been difficult for varying reasons, including norms of tobacco use among those in treatment, the high prevalence of use among treatment providers, and the perception that quitting smoking might negatively impact SUD treatment and recovery. As a recent ASHES highlighted, smokers can be successful in quitting smoking during SUD treatment. This week, ASHES reviews a study by Amanda Abraham and her colleagues that assessed the impact state tobacco control policies have on the availability of screening for tobacco use in SUD treatment programs.

What was the research question?

Are states with stronger tobacco control policies more likely to screen patients for tobacco use as part of their SUD treatment programs?

What did the researchers do?

The researchers conducted secondary data analysis using logistic regression to examine how state-level tobacco control policies relate to SUD treatment programs screening patients for tobacco use. The researchers used data from the 2012 National survey of Substance Abuse Treatment (N-SSATS) to determine if SUD programs screened patients for tobacco use. They used data from the Centers for Disease Control to assess state-level characteristics including implementation of a comprehensive smoke-free law that restricts smoking for worksites, restaurants, and bars, prevalence of smokers statewide, and state spending on tobacco prevention and control efforts as a percentage of CDC recommended spending. They used data from the US Census to assess state demographics and income, and data from the Tax Burden on Tobacco to assess state cigarette excise tax.

What did they find?

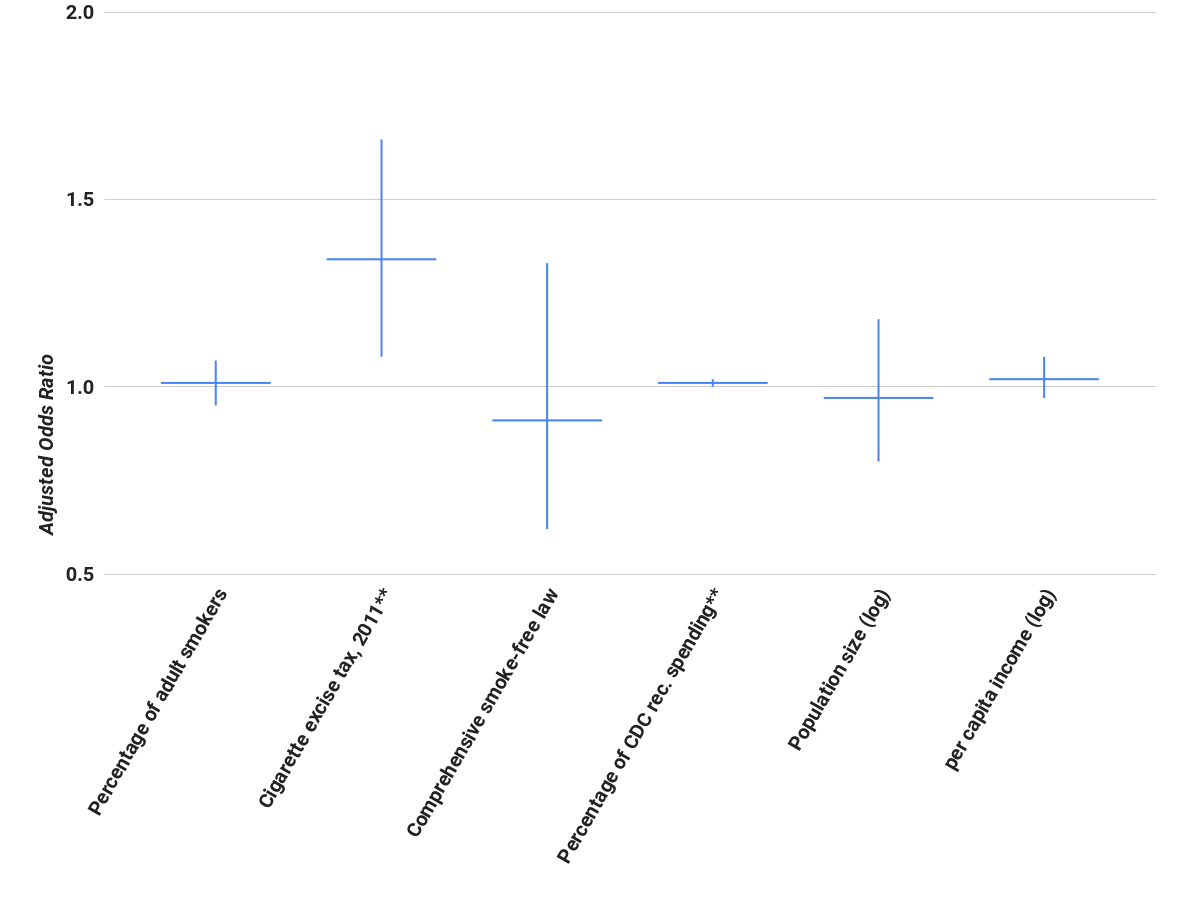

The researchers found that 61% of states had a comprehensive smoke-free law and the average state cigarette excise tax was $1.37. As Figure 1 shows, having a comprehensive smoke-free law was not associated with SUD treatment programs screening patients for tobacco use. However, both the amount of the cigarette excise tax and percentage of CDC recommended spending on tobacco control and prevention were positively associated with having tobacco cessation screening available at SUD treatment programs. A $1 increase in the excise tax was associated with 6.2% increase in the odds of a SUD treatment program offering screening, while a 25% increase in state spending as a percentage of the CDC recommended levels was associated with a 5% increase in the odds of SUD programs offering tobacco screening services.

Figure. Adjusted odds of SUD treatment programs screening patients for tobacco use given certain state-level characteristics (adapted from Abraham, et al., (2017). Click image to enlarge.

Figure. Adjusted odds of SUD treatment programs screening patients for tobacco use given certain state-level characteristics (adapted from Abraham, et al., (2017). Click image to enlarge.

Note. Characteristics labeled with ** had statistically significant effects on the odds of tobacco cessation screening availability. The horizontal bar is the adjusted odds ratio and the vertical line is the confidence interval.

Why do these findings matter?

Screening for tobacco use is the first step in any comprehensive cessation program. These findings lend some support for states increasing their cigarette excise tax and bringing tobacco prevention and control spending more in line with CDC guidelines. Increasing the state excise tax can help states fund medicaid reimbursements for smoking cessation efforts in SUD treatment programs. Left untreated, smokers are more likely to dropout of SUD treatment; funding cessation efforts might help reduce these dropouts and improve long-term recovery from SUDs. Future studies should assess the relationships established in this study using a longitudinal sample to determine if tobacco screenings and cessation increase and in turn, more favorable SUD outcomes.

Every study has limitations. What are the limitations in this study?

There are a couple of limitations common to this type of policy analysis using publicly available state-level data. The cross-sectional study design does not allow the researchers to examine the temporal relationship between tobacco screenings and the cigarette excise tax or tobacco control efforts. Second, this study was conducted at the same time that the Affordable Care Act (ACA) policies were implemented. These policies expanded Medicaid enrollment and required insurance companies to reimburse for some smoking cessation programs. It’s possible that states with higher cigarette excise tax were also more likely to expand their Medicaid populations under ACA. If this is the case, then we don’t know whether Medicaid expansion or the excise tax was responsible for greater tobacco screening efforts.

For more information:

If you are concerned about yours or a loved one’s nicotine use, visit our resource page for brief screens to assess tobacco and other substance use and self-help tools. For more resources including tips, tools, and support for quitting tobacco use visit the American Lung Association and SmokeFree.gov which has resources for teens, women, veterans, older adults, and Spanish speakers. For additional tools, please visit the BASIS Addiction Resources page.

— John H. Kleschinsky

What do you think? Please use the comment link below to provide feedback on this article.