Due to the recent proliferation of new investing applications , more laypeople are engaging in retail stock market trading. Though some people have profited from this activity, many others have experienced significant harms. For example, in one high profile case, a young retail trader died by suicide because he (mistakenly) believed he suffered a huge trading loss. Several interested parties have also raised concerns around the gamification of the stock market, especially in brokerage apps like Robinhood, combined with the rapid pace of today’s retail trading, which calls to mind casino gambling. To prevent harm, it is important to understand specific mechanisms driving harms from investing. Therefore, this week, The WAGER reviews a study by Leonardo Weiss-Cohen and colleagues that examined how problem gambling severity and market volatility influenced trading intensity.

What were the research questions?

(1) Does problem gambling severity relate to trading intensity? (2) Does volatility in the market affect trading intensity?

What did the researchers do?

The research team invited 604 participants from an online survey panel to complete a simulated trading task. All reported both gambling in the past year and having lifetime experience buying a financial asset like a stock or bond. The researchers formed four semi-equally sized groups based on their scores on the Problem Gambling Severity Index (PGSI); 1) recreational/no-risk gamblers, 2) low-risk gamblers, 3) medium-risk gamblers, and finally, 4) high-risk gamblers. In the trading task, each participant received a startup fund and had the opportunity to invest in six fictitious stocks on a computerized trading platform. Participants were randomly assigned to one of two conditions, one with high volatility (i.e., stock prices moving up and down frequently) and one with low volatility. The research team manipulated the stocks in both conditions so that they would both have the same overall return (i.e., potential profit), albeit with significantly more volatility in the high volatility condition. To better replicate real-world behavior, participants received financial bonuses based on the results of their trading, with better performance resulting in higher bonuses. The researchers studied how problem gambling severity related to the intensity with which participants made stock trades, and whether participants traded more intensely when faced with high market volatility.

What did they find?

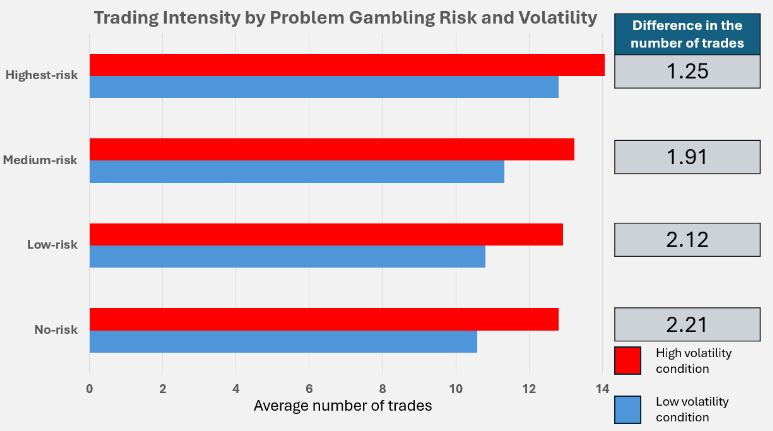

Contrary with other research, participants with more severe problem gambling did not trade more intensely. However, volatility did shape trading intensity; participants in the high volatility condition made 17% more trades compared to participants in the low volatility condition. This effect remained regardless of problem gambling severity and while controlling for financial literacy, overconfidence, age, and gender. Interestingly, exploratory analyses suggested that problem gambling severity may play a moderating role in predicting trading frequency, but only outside the highest levels of risk. Specifically, in all four of the gambling groups, participants in the high volatility condition traded more intensely than those in the low volatility condition; however, this difference was especially apparent in the three lowest-risk groups (see Figure).

Figure. Displays the mean number of trades for each PGSI category between conditions from exploratory analyses. The boxes on the right represent the average difference between participants in the high volatility vs. low volatility conditions for each level of PGSI severity. Click image to enlarge.

Why do these findings matter?

These findings are important for two reasons. Namely, they suggest that volatile assets such as cryptocurrencies or high-risk stocks (e.g., penny stocks) encourage more intense, gambling-like trading than less volatile assets mutual or index funds. This suggests that the gamification of brokerage apps like Robinhood and Webull may be putting more users at risk than was initially expected. Additionally, because the effects of volatility were strongest among no-risk participants, messaging efforts should potentially target lower-risk traders and gamblers as well. Often, outreach messaging focuses on those most at-risk in the population, yet this study suggests that those at lower-risk might actually be experiencing more harms from trading.

Every study has limitations. What are the limitations in this study?

This study occurred in a simulated environment in which participants did not trade with their own personal money, so the external validity of this study is in question. Additionally, compared to the average online brokerage account, this study provided relatively modest amounts of capital to trade with. It is quite likely that higher stakes with more money could influence the results of this study, possibly by encouraging more risky trading.

For more information:

Individuals who are struggling with problem gambling may find support through Gamblers Anonymous. They offer in-person and virtual meetings. Others who are concerned about their trading or gambling behavior may benefit from visiting the website for The National Council for Problem Gambling. Additional resources can be found at the BASIS Addiction Resources page.

—John Slabczynski