Addiction causes a variety of physical and psychological harms. These harms often differ depending on the specific object of addiction. For example, Gambling Disorder is often associated with financial harms, including unsustainable spending and debt. Developing a better understanding of how these harms uniquely manifest is important for informing harm reduction programs. With Gambling Disorder, it is important to identify variables that exacerbate and reduce these financial harms. This week, The WAGER reviews a study by Isaac Koomson and colleagues that examined relationships among problem gambling, financial stress, and financial resiliency.

What are the research questions?

Is there a relationship between problem gambling and financial stress? Does financial resiliency mediate this relationship?

What did the researchers do?

The researchers used data from the annual Household, Income and Labour Dynamics in Australia survey. This survey collects data on a nationally representative sample of approximately 17,000 Australians each year; only data from 2015 to 2018 were used for this study. Survey questions included the Problem Gambling Severity Index (PGSI), as well as items regarding participants’ financial status, ranging from participants’ ability to afford individual bills such as gas and electricity to their reliance on social welfare for income assistance. The researchers then used these items to create four variables that measured different types of financial stress: (1) financial difficulty, (2) cashflow, (3) hardship, and (4) any stress. They used an additional item regarding participants’ ability to generate an emergency $2,000 fund to measure financial resilience.

What did they find?

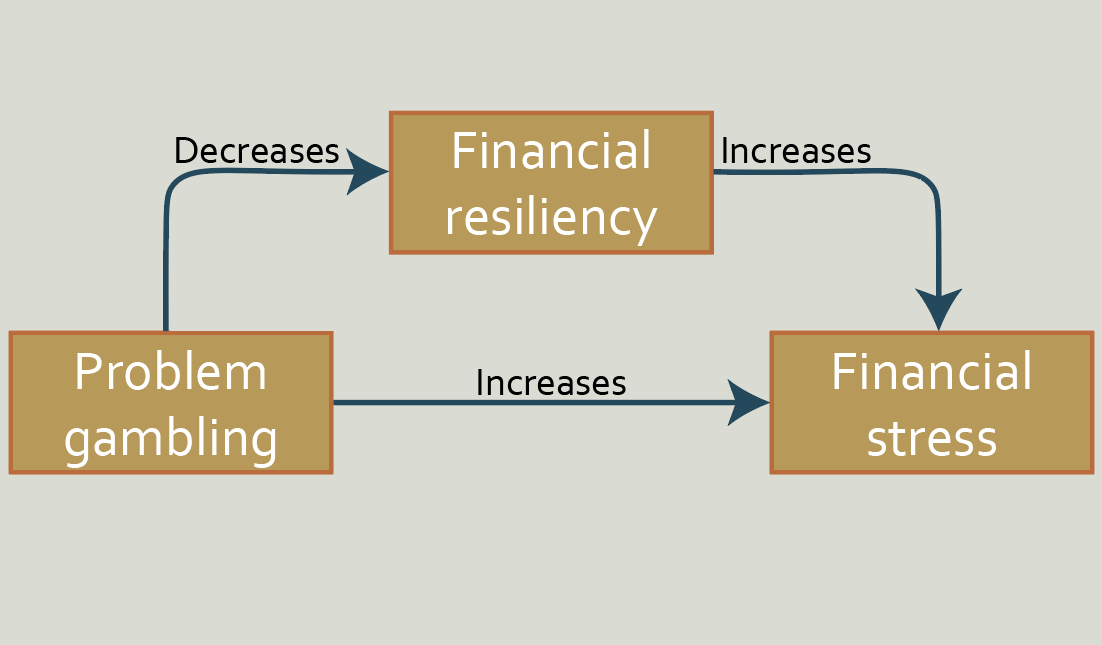

Problem gambling severity was positively associated with all four measures of financial stress. The number of gambling activities that each participant engaged in, and the number of gamblers in each participant’s neighborhood, were also positively associated with all four financial stress measures. Additionally, the relationship between problem gambling and financial stress varied between gambling activities, such that buying scratch tickets and playing poker machines were associated with more financial stress, while horse and dog race betting showed the opposite pattern. Finally, mediation analyses revealed that financial resiliency partially accounted for the relationship between problem gambling and financial stress1 (see Figure). In other words, problem gambling appears to cause financial stress partially because it weakens the ability to cope with sudden financial demands.

Figure. Relationships between problem gambling and financial measures. As shown, problem gambling directly increases financial stress. Simultaneously, problem gambling also decreases financial resiliency, which in turn further increases financial stress. Click image to enlarge.

Why do these findings matter?

These findings suggest that financial education and literacy could be useful intervention targets when attempting to reduce gambling harms. Additionally, understanding the role of financial resilience is important for equity reasons. While 56% of Americans lack the savings to cover a $1,000 emergency bill, Black and Latino/Latina people are disproportionately experiencing economic insecurity. As a result of this baseline lack of financial resilience, problem gambling is likely to be especially devastating among these groups.

Every study has limitations. What are the limitations in this study?

The way this study defined financial resilience (i.e., the ability to raise $2,000 for an emergency) may have led participants to consider payday loans or credit lines as payment options though those only delay costs—in return for a larger expense later. This means that some participants may not actually be able to afford such a sudden cost despite claiming otherwise. Additionally, financial stress had potential limitations, as the items only inquired about help-seeking behavior and the inability to pay bills. Living paycheck to paycheck or marginally above these lines can still be financially stressful.

For more information:

U.S. residents concerned about their gambling can find helpful information at the National Council on Problem Gambling. International readers may find support at the International Center for Responsible Gaming. Additional resources can be found at the BASIS Addiction Resources page.

— John Slabczynski

What do you think? Please use the comment link below to provide feedback on this article.

________________

[1] The researchers employed the Baron and Kenny (1986) method for testing for mediation. This method involves a series of regression analyses and indicates whether mediation is present based on whether the magnitude of the key predictor variable is reduced when including the mediating variable in the model.