Generally

speaking, people tend to follow others’ behavior to avoid conflict (Cialdini

& Goldstein, 2004). In addition to helping us avoid conflict, social

conformity may help us deal with negative emotions when things go awry (Berns

et al., 2011). Is it true for gambling losses? This week’s WAGER reviews an

experiment that examined whether social conformity acts as an emotional buffer

in response to bad outcomes from gambling (Yu & Sun, 2013).

Methods

- The researchers

paired 21 participants (10 male, mean age = 20.23 years) with two other people

in a group gambling task. Unbeknownst to the subjects, these two people were

experiment-related confederates. - The task

required participants to choose one of two options for a chance to win a cash

prize.- Participants

were not told, but the actual chance of winning was always 50%.

- Participants

- After making a

choice, participants were informed about whether they won or lost, and the confederates’

choices.- The

participant might win alone, lose alone, win with others, or lose

with others.

- The

- During the

gambling task, the researchers used an electroencephalogram (EEG) to measure

subjects’ brain response to the specific events of the task.- EEG

measurements were for two types of brain activity related to monitoring

negative outcomes and rewards. [1]

- EEG

Results

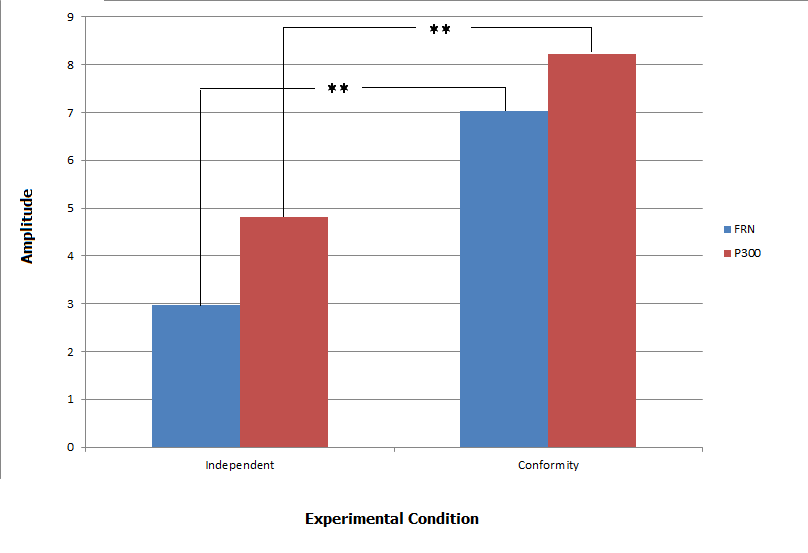

- Across all

trials, participants’ choices tended to mirror that of the confederates, even

though this strategy did not produce more wins. This suggests that they conformed

to a social norm, even though it did not lead to more monetary rewards. - When

participants either won alone or lost alone, they tended to show more negative deflection

in one of the measures of brain activity, suggesting increased conflict

detection and stress response. See Figure 1. - The EEG activity

suggested that participants were less sensitive to monetary outcomes during

conforming choices (i.e., win with others and lose with others); compared to non-conforming

choices (i.e., win alone and lose alone).

Figure 1: Averaged waveform amplitudes between

conforming, independent, and baseline conditions (adapted from Yu & Sun,

2013)

**

p < .001

Limitations

- These EEG

measurements are used when researchers want to get precise information about

the timing of brain activity; they are not used to measure specific areas

located within the brain. Other kinds of measurement (e.g., fMRI) might give

additional information about brain areas and patterns associated with emotion

regulation and stress response. - We cannot

entirely rule out the possibility that the subjects did not learn rules and

succumb to normative pressure, rather than primarily seek to avoid negative emotions.

Conclusions

When

they chose differently from their confederates, participants showed brain

activity associated with detecting errors and registering negative emotions

from loss. People who followed the crowd showed reduced sensitivity to outcomes,

even when they lost, which implies that conformity reduced the emotional impact

of bad outcomes. People might learn to conform to others’ behavior because of

risk aversion and to mitigate the sting of losing. This might be adaptive in

some ways, but over time, might lead to bad decisions. People who are

risk-averse and prone to conforming might make poor financial choices when

gambling in the company of others.

– Kat Belkin

What do you think? Please use the

comment link below to provide feedback on this article.

References

Berns

G.S., Chappelow J., Zink C.F., Pagnoni G., Martin-Skurski M.E., et al. (2005). Neurobiological correlates of

social conformity and independence during mental rotation. Biological

Psychiatry, 58, 245–253.

Cialdini

R.B., Goldstein, N.J. (2004). Social influence: Compliance and conformity. Annual Review

of Psychology, 55, 591–621.

Yu,

R., Sun, S. (2013). To conform or not to conform: Spontaneous conformity

diminishes the sensitivity to

monetary outcomes. PLoS ONE 8(5): e64530.

[1]

The two brain circuits were the FRN, which performs a role in encoding reward

error prediction, conflict detection, and emotional response and peaks between

250–300 ms post onset of outcome feedback; and the P300, which performs a role

in encoding reward valence and reward magnitude, and peaks around 300–600 ms

after stimulus presentation.