Case 1: In addition to losing a substantial amount of her retirement fund, Mrs. X borrowed heavily from loan and credit card companies to finance the gambling trips she took with her husband. By June of 1990, her gambling and credit card debts totaled over $33,700. She filed for bankruptcy soon after.

Case 2: Mr. Y’s debt reduction plan involved transferring balances from credit cards with high rates of interest to those with low rates. However, court proceedings revealed that Mr. Y continued to use these cards to support his gambling and had no intention of repaying his creditors.

The cases cited above are based on actual federal bankruptcy court proceedings. Bankruptcy remains an option for gamblers whose debts far exceed their ability to repay. For some, bankruptcy is an opportunity to begin anew and

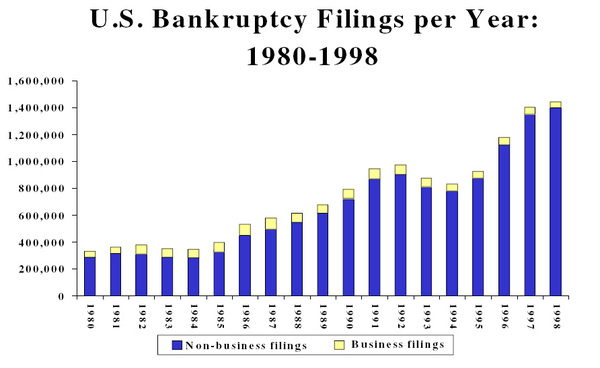

regain control of financial matters. But the number of bankruptcies filed each year has soared in recent times (see chart below), prompting creditors and some legislators to seek an overhaul of the system.

On May 5th, the House of Representatives passed HR 833, commonly known as the Bankruptcy Reform Act of 1999. The bill passed after a vote of 313 to 108, and is now slated for consideration in the Senate. The proposed legislation consists of numerous amendments to Title 11 of U.S. Code, which deals with bankruptcy. Most significantly, the proposed legislation would make it more difficult for debtors to be classified under chapter 7 of the Title, which generally dissolves any lien creditors might have on the debtor’s future earnings. If the bill is enacted, more debtors will likely fall under chapter 13, which does not absolve the debtor to the extent permitted by chapter 7.1

Secondly, the legislation would make it easier for creditors to seek a dismissal of a bankruptcy claim by demonstrating misconduct by the debtor. Thus, if “substantial abuse” by the debtor is proven, his or her bankruptcy claim can be discarded outright.2

Might the actions in the cases above qualify as “substantial abuse”? That is, could gambling away funds earmarked for debt repayment constitute grounds for dismissal? Will it become more difficult for recovering pathological gamblers or others with gambling debts to make a fresh start? It is these questions that may prove most relevant for gamblers seeking bankruptcy. Many consider the bill passed by the House last month to be a boon to credit card companies at the expense of consumers. But bankruptcy law is complicated, and it is difficult to predict exactly what effect these changes will have. Furthermore, the bill is still a long way from enactment; it must first pass througn the Senate and be signed by the President.

Sources: 1For the Record. (1999, May 13). The Washington Post, p.M06. 2Bankruptcy Reform Bill, H.R. 833, 106th Congress, 1999 (http://thomas.loc.gov/)

The WAGER is a public education project of the Division on Addictions at Harvard Medical School. It is funded, in part, by the Massachusetts Council on Compulsive Gambling, the Andrews Foundation, and the National Center for Responsible Gaming.