As millions of Americans pore over a seemingly endless sea of tax code and regulations this month, they can add this late-breaking legal decision to their repertoire of IRS knowledge: Pathological gambling does not relieve one of income reporting responsibility. In January, the 9th Circuit U.S. Court of Appeals upheld a previous ruling barring testimony concerning the cognitive distortion and denial experienced by pathological gamblers. The defendent, William Scholl, is a former Arizona superior court judge with a gambling problem. At one point, his combined casino debts totalled $163,000. Cash transactions in excess of $10,000 generate an IRS paper trail, so Scholl deposited his winnings in $5,000 increments to avoid detection. Furthermore, he failed to report his winnings on his annual tax returns.* Indicted in late 1995, Scholl’s defense called Dr. Robert Hunter as an expert witness in the field of compulsive gambling, with the expectation that he would give testimony that the disorder can impair the ability to accurately keep records. District Judge Roslyn Silver limited Hunter’s testimony to diagnosing the defendent as a pathological gambler at the time of the offenses. In addition, Hunter was limited to discussing the 10 diagnostic criteria listed in DSM-IV.** Although “denial” and “distortions in thinking” are mentioned in DSM-IV, they are categorized as associated features and not as primary diagnostic criteria. It was this ruling that the Court of Appeals upheld earlier this year.

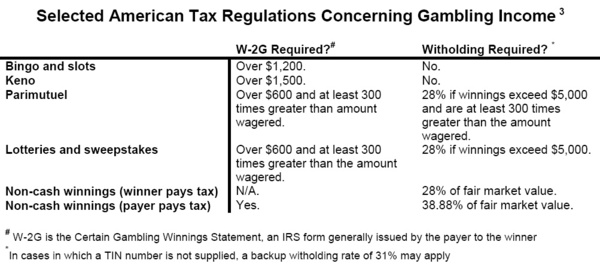

How will this decision influence future revisions of the pathological gambling section of DSM-IV? Of the tax code? Of the penal code? In the case of the former, the intensely political nature of diagnoses is highlighted. For the tax and penal laws, it may take several more cases such as this one to gauge how jurisprudence will ultimately react to new understandings of disordered gambling. In the meantime, the table below summarizes reporting requirements for gambling-related income. It should be remembered that some gambling losses may be deducted.****

Sources: * United States v. William L. Scholl, Nos. 97-10143, 97-10248 (9th Cir., January 27, 1999). ** 9th Cir. limits expert testimony on gambling addiction. (March 1999). Gaming Industry Litigation Reporter, 3(11), 4. 3 Internal Revenue Service. Instructions for forms 1099, 1098, 5498 and W-2G. **** Internal Revenue Service. Instructions for schedules to form 1040.

This public education project is funded, in part, by The Andrews Foundation and the National Center for Responsible Gaming.