The WAGER Vol. 5(10) – Betting on the Bull: Day Trading

Two California women recently testified that their transactions cost them tens of thousands of dollars of their life savings.3

A woman from Illinois testified that her son’s transactions caused financial ruin- and, ultimately, his life.3

These stories may sound remarkably familiar to clinicians who treat pathological gamblers. But the transactions mentioned in these two cases are not bets or wagers, but day trades. Day trading is "a strategy that generally involves making multiple purchases and sales of the same security during the day to profit from short-term price movements."1 Much attention has been given to the day trading phenomenon in the months since last July, when a disgruntled day trader shot 12 victims at two day trading firms in Atlanta. During a recent Senate subcommittee hearing on the topic, chairwoman Susan Collins (R-Maine) remarked, "I believe day trading can be fairly compared to certain types of gambling."2 What exactly is day trading, and how does it relate to pathological gambling?

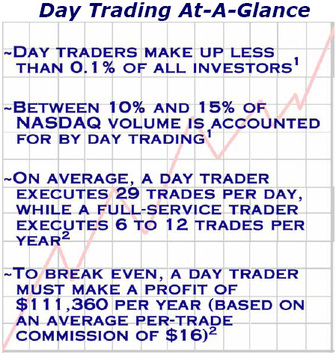

The recent report of the General Accounting Office explicitly states that day trading and online investment are not necessarily one and the same. In general, day traders conduct their transactions on-site at firms that provide superior technology and access to the latest market research and information. Traders execute transactions at a rapid rate (see figure), paying commissions to the firms. Day trading, in general, is a full-time occupation.

Critics hold that day traders are not adequately informed of the riskiness of their transactions. Similar criticisms have been leveled by those who favor prominently posting the odds of winning in all gambling venues. But gambling studies research suggests that increasing disclosure may not deter pathological gamblers, who suffer from cognitive distortions that prevent them from fully understanding the laws of

probability [see WAGER 4(45) and WAGER 4(7)]. If excessive day trading is an analogous construct to pathological gambling, then the impact of increased risk disclosure is uncertain.

If day trading is a concern when market conditions are favorable, it will be interesting to see how the discourse will change when the bull becomes a bear.

References

1General Accounting Office. (2000). Securities operations: Day trading requires continued oversight. (GAO report GGD-00-61). Washington, DC: General Accounting Office.

2Dart, Bob. (2000, February 25). Curbs on day trading debated. The Atlanta Journal and Constitution, 1A.

3Cantlupe, J. (2000, February 25). Senate panel hears day-trading horror stories. San Diego Union-Tribune, C-1.