The WAGER, Vol. 3(50) – Money matters

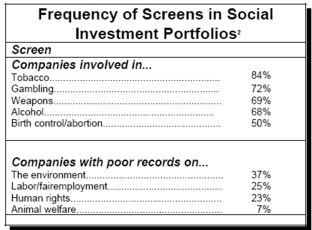

At the close of calendar year 1997, 66.5 million Americans owned mutual funds, accounting for 78% of the the $4.490 trillion in assets held in mutual funds. With over 6,700 bond, equity, and money market funds from which to choose, investors have more options than ever before [1]. Certain funds assemble their portfolios with specific aims in mind, investing in equities with particular characteristics. Thus, the market offers investors funds that specialize in high technology, international companies, high-risk ventures, and numerous other themes. In recent years, investment companies have offered “socially responsible” mutual funds. Although the definition of “socially responsible” varies considerably across funds, most use as a starting point a list of exclusionary criteria against which all possible investments are tested. For example, fund managers may choose to screen out companies with poor environmental records. Positive screens are sometimes employed, favoring companies with strong commitments to community investing or subsidized childcare. According to a recent report issued by the Social Investment Forum, the total assets in socially screened investments rose from $162 billion to $529 billion between 1995 and 1997. Of this $529 billion, $96 billion is held in 144 socially responsible mutual funds. Although the qualitative and quantitative stringencies of the screens utilized vary considerably, the table below presents some of the exclusionary criteria common to many funds [2]. According to the Social Investment Forum data, more mutual funds are willing to invest in companies that produce weapons or alcohol than those involved in the gambling industry. Why does gambling rank so high on a list of shunned industries that includes human rights violators and environmental detractors? If the funds bill themselves as socially responsible, then it is reasonable to think that industries on the screen list have been selected because of the negative social impact inherent in their business. A significant segment of investors seem to think that gambling is not a socially prudent enterprise. As the gaming industry evolves in coming years, it will be interesting to note any corresponding changes in these investment attitudes.

Sources:

- 1998 Mutual fund fact book, Investment Company Institute, pp.36, 64 (www.ici.org)

- 1997 Report on responsible investing trends in the United States, Social Investment Forum, (www.socialinvest.org)

This public education project is funded, in part, by The Andrews Foundation and the National Center for Responsible Gaming.

This fax may be copied without permission. Please cite The WAGER as the source.

For more information contact the Massachusetts Council on Compulsive Gambling,

190 High Street, Suite 5, Boston, MA 02110, U.S. {